If you’re searching for the best AI stocks 2026 has to offer, you’re not alone. AI is no longer just a trend that people talk about on tech podcasts. It is becoming real infrastructure, like electricity for software. Companies across chips, cloud, enterprise software, healthcare, and defence are racing to build or buy AI capability.

And yeah, AI hype is loud. But here’s the thing: there is real money behind it. AI demand is pushing data center investment and chip supply chains hard. Nvidia’s reported financial results show how aggressively the AI infrastructure cycle is expanding.

This blog is written to help normal investors (not just Wall Street pros) identify the Best AI stocks to watch in 2026, understand why these companies matter, and learn what signals to track before investing.

Why 2026 Could Be a Major Year for AI Stocks

AI stocks are moving because the AI economy is scaling up fast. Market research reports estimate rapid growth in AI and generative AI over the coming years. For example, Grand View Research projects the generative AI market to grow significantly through 2033 with strong CAGR from 2026 onward.

Also, the AI chip market growth outlook remains massive, with multiple market research firms forecasting strong expansion.

In simple terms:

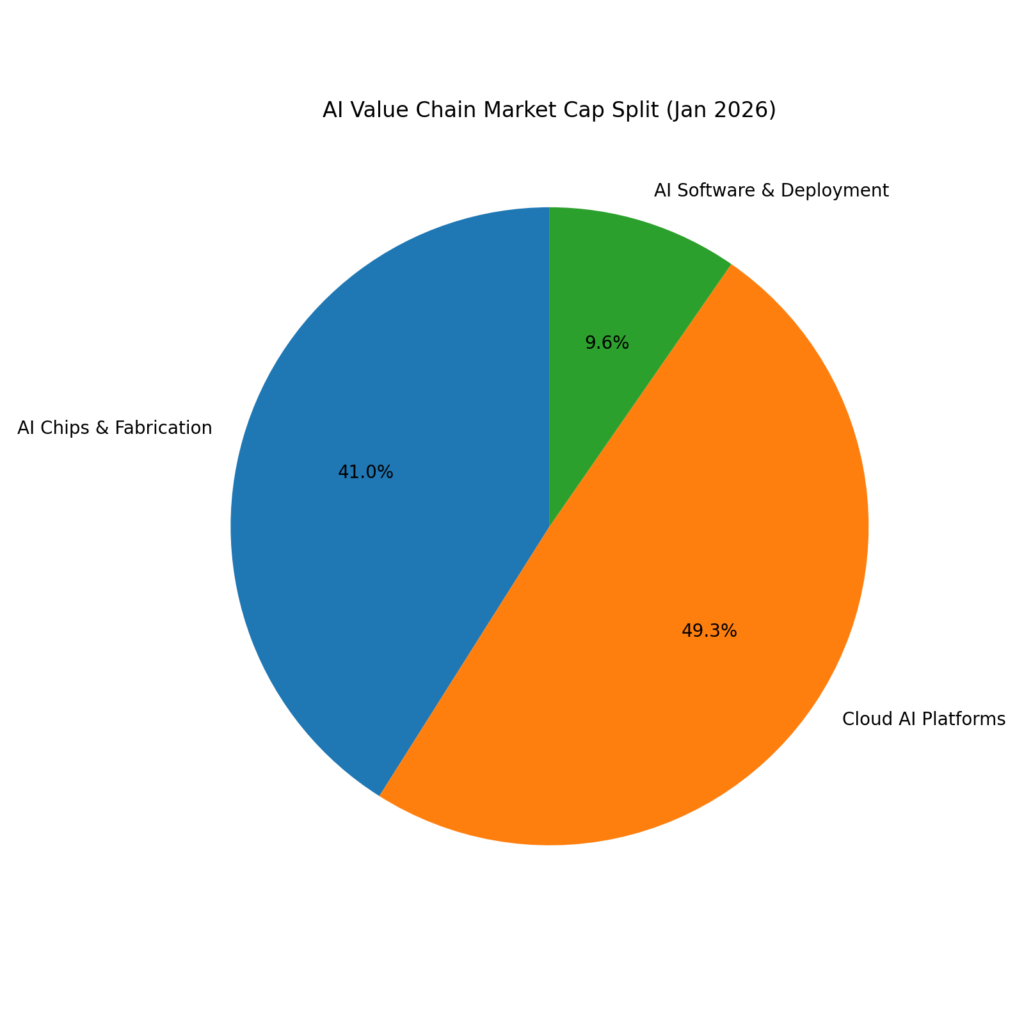

AI is not just software anymore. It is compute, storage, bandwidth, power, and advanced chips.

Key forces driving AI stock growth:

- AI workloads increasing inside cloud and enterprise

- Explosive demand for data center accelerators (GPUs, ASICs)

- AI adoption in productivity tools (office, search, customer support)

- Increased government and defence AI spending

This is why top AI stocks 2026 are not only software companies. The biggest winners are often the “picks and shovels” providers.

How to Identify the Best Artificial Intelligence Stocks 2026

Before buying any AI stock, use this checklist. It keeps you from buying hype like a tourist buying fake maple syrup.

Look for:

Real AI revenue & not just “AI features”

Strong data center exposure

High gross margin products

Strong free cash flow

Competitive moat like hardware, cloud ecosystem, proprietary data

Avoid:

AI stocks with only buzzwords and no revenue proof

Unprofitable firms burning cash with no path to profits

Companies heavily diluted by constant share issuance

Best AI stocks to watch in 2026

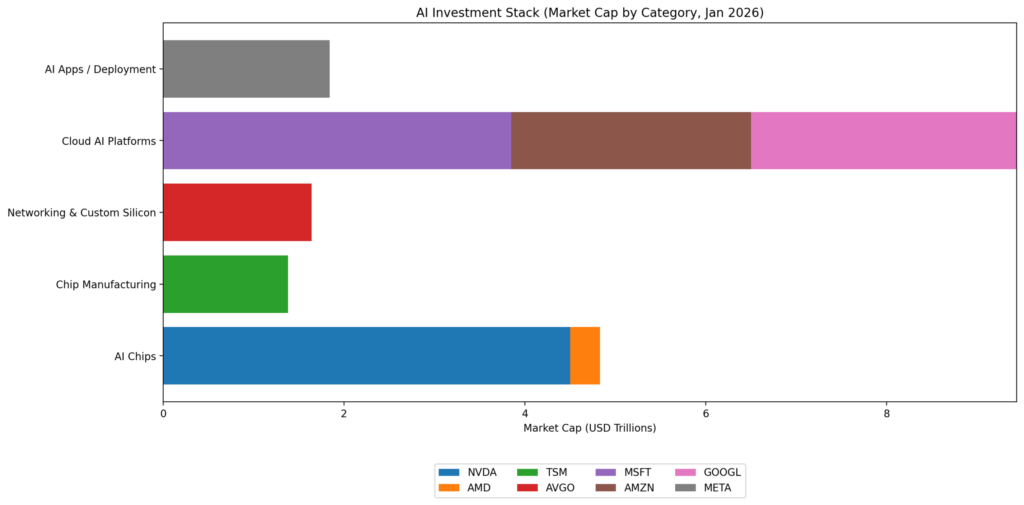

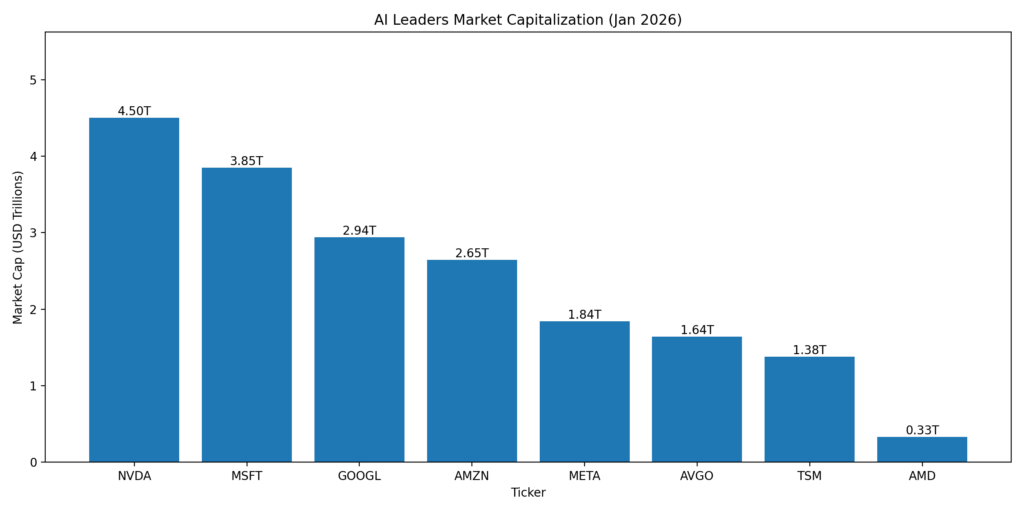

1. NVIDIA (NVDA)

If AI had a currency, Nvidia would be printing it.

Nvidia remains the dominant leader in AI accelerators powering modern data centers. Their reported financial results show extreme growth driven by data center demand, with record quarterly revenue in fiscal 2026 reporting.

Why NVDA is one of the best AI stocks 2026:

- AI GPU platform dominance

- CUDA ecosystem lock-in (developers stay loyal)

- Data center revenue growth engine

Watchouts:

- Valuation volatility

- Competition from AMD and custom chips

2. Microsoft (MSFT)

Microsoft is not just “investing in AI”. It is embedding AI into how millions work daily.

Microsoft’s advantage is distribution. When Microsoft pushes Copilot across Office, Azure, and enterprise tools, it becomes sticky. This is how a tech company turns AI into recurring revenue.

Why MSFT ranks among AI stocks to buy 2026:

- Azure cloud scale

- AI in enterprise productivity

- Defensive moat and stable balance sheet

3. Alphabet (GOOGL)

Alphabet’s AI story is getting stronger, especially with Gemini models and expanding AI services across Search, YouTube, and cloud.

In fact, recent reporting highlights how Alphabet’s AI momentum has significantly boosted its value and market sentiment.

Why Alphabet is top AI stock 2026 material:

- Deep AI research strength

- Massive data advantage

- TPU chips as Nvidia alternatives

4. Taiwan Semiconductor Manufacturing (TSMC)

No chips = no AI.

TSMC is the backbone of advanced semiconductor manufacturing. Almost every major AI hardware company depends on it.

Reuters reporting highlights how AI demand continues driving strong revenue expectations and profit growth for TSMC, with continued demand for advanced nodes.

Why TSMC is one of the best artificial intelligence stocks 2026:

- Dominates advanced chip fabrication

- Benefits from the entire AI hardware boom

- Strategic importance globally

Watchouts:

- Geopolitical risk

- Capex pressure

5. Broadcom (AVGO)

Broadcom is becoming a serious AI infrastructure winner.

It benefits from:

- Networking for AI data centers

- Custom AI silicon trend (ASICs)

- Enterprise software cash flows

Broadcom is the “quiet rich guy” of AI investing. Not always flashy, but very profitable.

Quick Quiz

Which company benefits from AI demand even if it does not sell GPUs?

A) Nvidia

B) TSMC

C) Palantir

Answer: B) TSMC, because it manufactures the advanced chips used across the AI ecosystem.

6. Advanced Micro Devices (AMD)

AMD is the most serious challenger to Nvidia in AI accelerators.

Their AI GPU line (MI300 series) helped push strong data center demand, and they continue guiding toward higher AI adoption. Reuters has also covered AMD’s results and how investor sentiment is shaped by AI growth expectations.

Why AMD belongs in the best AI stocks 2026 list:

- Competing AI accelerator roadmap (MI300 now, MI400 expected in 2026)

- Data center momentum

- Pricing flexibility compared to Nvidia

What investors should track:

- How much AI GPU revenue AMD produces annually

- Hyperscaler adoption (Azure, AWS, etc.)

- MI300 to MI400 transition execution

Note: AMD has higher volatility than Microsoft or Alphabet, but that is the tradeoff for growth exposure.

7. Amazon (AMZN)

Amazon is an AI stock in disguise.

Most people look at Amazon as e-commerce, but serious investors focus on AWS. AWS crossed $100 billion annual revenue in 2024, with strong year-over-year growth.

Amazon is building AI monetization through:

- AWS Bedrock (foundation model platform)

- Trainium and Inferentia chips for AI workloads

- AI services that enterprises pay monthly

Why this is one of the smartest AI stocks to buy 2026:

- AI demand drives AWS growth

- AWS is a high margin business

- Amazon reinvests cash into infrastructure aggressively

Amazon is like that quiet performer, not the loudest in AI headlines, but steadily growing through AWS and enterprise AI demand.

8. Meta Platforms (META)

Meta is spending like crazy on AI infrastructure, and that matters.

In 2025, Meta raised its capital expenditure outlook for AI and data centers to around $64 billion to $72 billion, mainly driven by infrastructure hardware.

Reuters also reported Meta boosting its spending outlook further and highlighting bigger compute ambitions across AI investments.

Why Meta fits the best artificial intelligence stocks 2026 theme:

- Massive AI compute buildout

- AI powers recommendation systems

- Llama models give them strategic control

What to watch:

- AI capex efficiency (spending is big, returns must follow)

- Monetization through ads, Reels, and AI assistants

META is not low risk. But it is one of the strongest “AI adoption at scale” plays.

9. Marvell Technology (MRVL)

Marvell is in the AI plumbing business: networking and connectivity for data centers.

As AI clusters grow, networking becomes critical because AI training is basically a data transfer war. Reuters covered Marvell’s acquisition of XConn to strengthen its position in AI infrastructure networking.

Why MRVL is one of the top AI stocks 2026:

- Direct exposure to AI data center networking demand

- Strategic acquisitions to grow AI capability

- Infrastructure picks and shovels play

This is a great stock for readers who missed Nvidia early and still want AI infrastructure exposure.

10. Palantir (PLTR)

Palantir is one of the most polarizing AI stocks.

But it deserves attention because it is deeply tied to:

- Government data + AI

- Enterprise adoption through AIP (Artificial Intelligence Platform)

Why Palantir can be a 2026 AI winner:

- Strong positioning in mission-critical systems

- Government contracts are sticky

- Enterprise AI adoption is rising

What to watch:

- Commercial revenue growth

- Profitability stability

- Customer concentration risk

PLTR is not a safe bet. It is a high conviction bet.

Quick Comparison Table

| Company | Ticker | AI Category | Strength | Key Risk |

|---|---|---|---|---|

| NVIDIA | NVDA | AI GPUs, compute platform | Dominant AI hardware leader | Valuation volatility |

| AMD | AMD | AI GPUs, data center accelerators | Nvidia challenger | Execution risk |

| Microsoft | MSFT | Cloud + AI tools | Enterprise AI distribution | Slower growth but safer |

| Alphabet | GOOGL | Models + data + TPU chips | Research + data advantage | Search disruption risk |

| Amazon | AMZN | AWS AI + custom chips | Cloud monetization | Margin pressure from capex |

| TSMC | TSM | Chip manufacturing backbone | AI demand supports growth | Geopolitical risk |

| Broadcom | AVGO | Networking + custom silicon | AI infra diversification | Customer concentration |

| Meta | META | AI infra + ad optimization | Scale + compute buildout | Very high capex |

| Marvell | MRVL | AI networking | AI data flow demand | Competitive pressure |

| Palantir | PLTR | AI software platform | Gov + enterprise AI | Volatility, valuation |

The Big Risk in 2026 (AI Bubble vs AI Infrastructure Reality)

Investors must be honest: AI hype exists.

But the strongest best AI stocks 2026 are the companies with:

- real revenue

- real infrastructure demand

- real enterprise adoption

One reason this is important: data center spending is rising fast, driven by the AI arms race. IoT Analytics reported global data center infrastructure spending hit around $290 billion in 2024, heavily influenced by the largest tech firms.

Also, Nvidia continues posting record data center revenue, supporting the idea that AI infrastructure demand is not imaginary. Nvidia reported record data center revenue in fiscal Q3 2026 (ended Oct 26, 2025).

Simple warning for you:

If a company has no AI revenue and no customer proof, it is not a top AI stock. It is just noise.

Quick Quiz

Which stock is the biggest AI “picks and shovels” company in the world?

A) Tesla

B) TSMC

C) Netflix

Answer: B) TSMC, because it manufactures advanced chips that power AI hardware across the world.

FAQs

What are the best AI stocks 2026 for beginners?

For beginners, the best artificial intelligence stocks 2026 are usually the stable leaders: Microsoft, Alphabet, Amazon, and Nvidia.

Are AI stocks to buy 2026 too expensive now?

Some are expensive. That is why investors should focus on companies with strong earnings, clear demand, and recurring AI revenue. Avoid hype-only AI stocks.

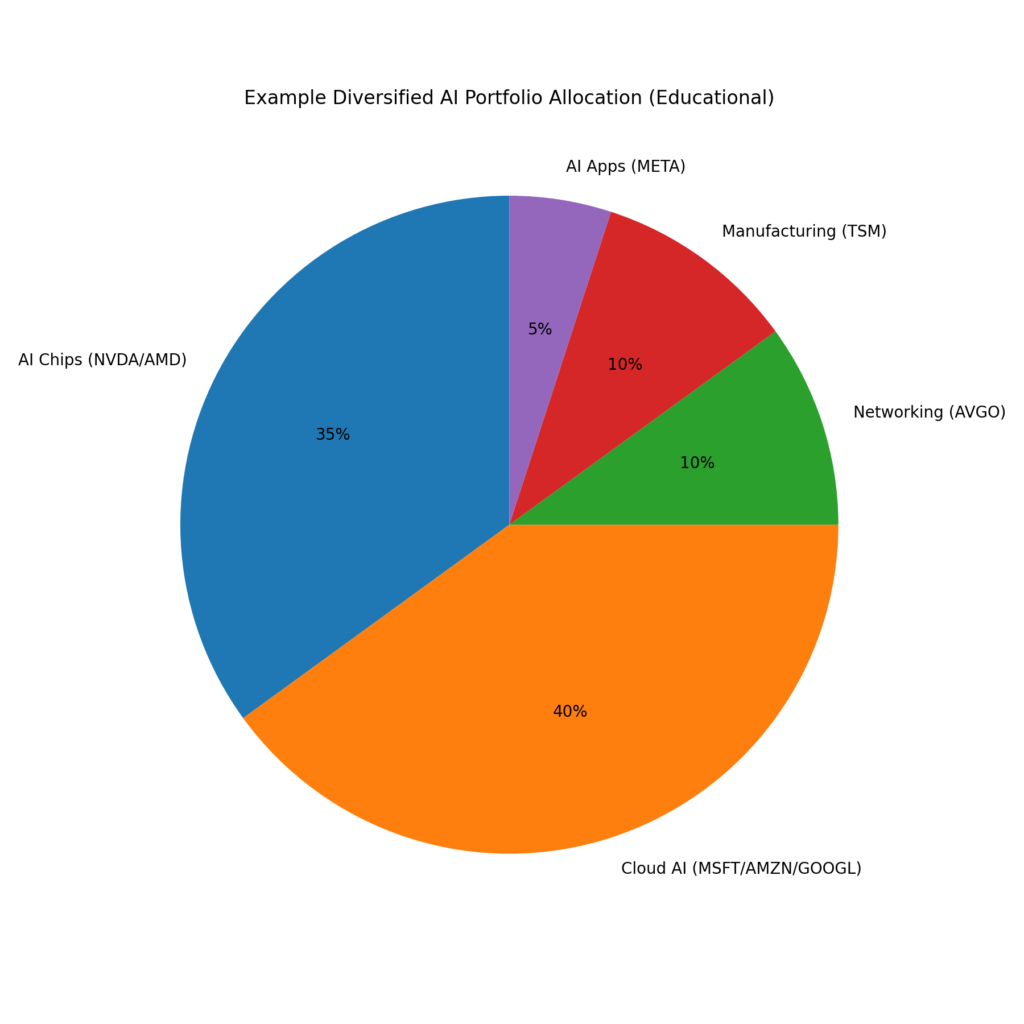

What is the safest way to invest in top AI stocks 2026?

Use diversification:

2 infrastructure stocks (Nvidia, TSMC)

2 cloud AI stocks (Microsoft, Amazon)

1 optional high-risk AI software play (Palantir)

Conclusion: What Makes a Stock One of the Best AI Stocks 2026

In 2026, AI winners will not be random “AI” companies. The winners will be:

- Infrastructure providers

- Cloud platforms

- Semiconductor backbone companies

- Software firms with real customer adoption

AI is not just the future. It is becoming the present infrastructure.

And the best AI stocks 2026 are the companies selling the infrastructure, not just talking about it.